The Invisible Economic Crisis

3 minute readPublished: Monday, October 27, 2025 at 10:00 am

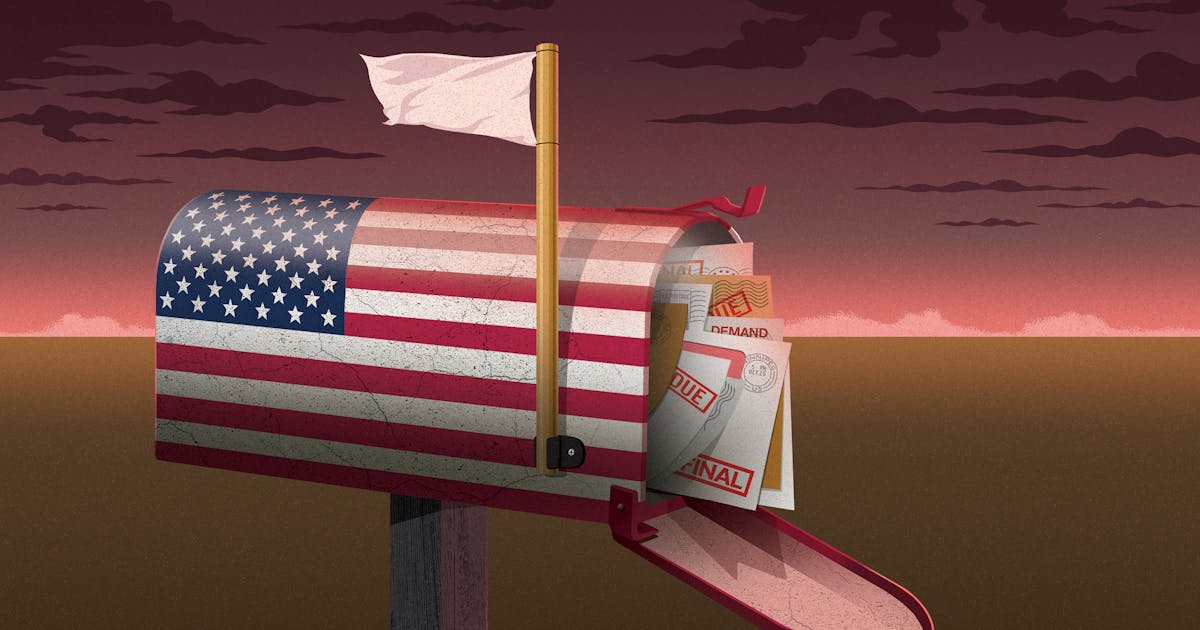

The Invisible Economic Crisis: Debt and the Changing Landscape of Financial Strain

A growing economic crisis is unfolding, marked by rising debt and evolving financial pressures on consumers. This crisis is characterized by rapid evictions, the expansion of "buy now, pay later" (BNPL) loans, and the potential for long-term financial consequences.

One key aspect of this crisis is the aggressive eviction practices of corporate landlords. According to a spokesperson, these evictions are often swift, precise, and disproportionately affect certain racial groups. The spokesperson cited an example of a renter facing a staggering $90,000 in eviction debt.

Simultaneously, the rise of BNPL loans is reshaping consumer behavior and raising concerns about financial stability. Initially designed for larger purchases, BNPL is increasingly being used for everyday expenses. While BNPL accounts for a relatively small percentage of online transactions, its growth has been significant, increasing from 2% in 2020 to 6% in 2024. A recent survey revealed that nearly a quarter of BNPL users are now utilizing these loans for groceries.

The expansion of BNPL into routine spending suggests growing financial strain among consumers. Despite being marketed as a convenient solution, BNPL loans may soon carry more weight. A recent announcement indicated that BNPL loans will be included in credit reports, potentially impacting borrowers' financial records.

BNN's Perspective: The trends highlighted in this report paint a concerning picture of financial vulnerability. While BNPL offers convenience, its increasing use for essential expenses and the potential for negative impacts on credit scores warrant careful consideration. Policymakers and consumers alike should be aware of the risks associated with these evolving financial products and practices.

Keywords: eviction debt, buy now pay later, BNPL, consumer debt, financial strain, credit reports, online shopping, economic crisis, corporate landlords, financial vulnerability