Is a financial market crash around the corner?

3 minute readPublished: Tuesday, October 14, 2025 at 5:58 pm

Financial Experts Warn of Potential Market Downturn

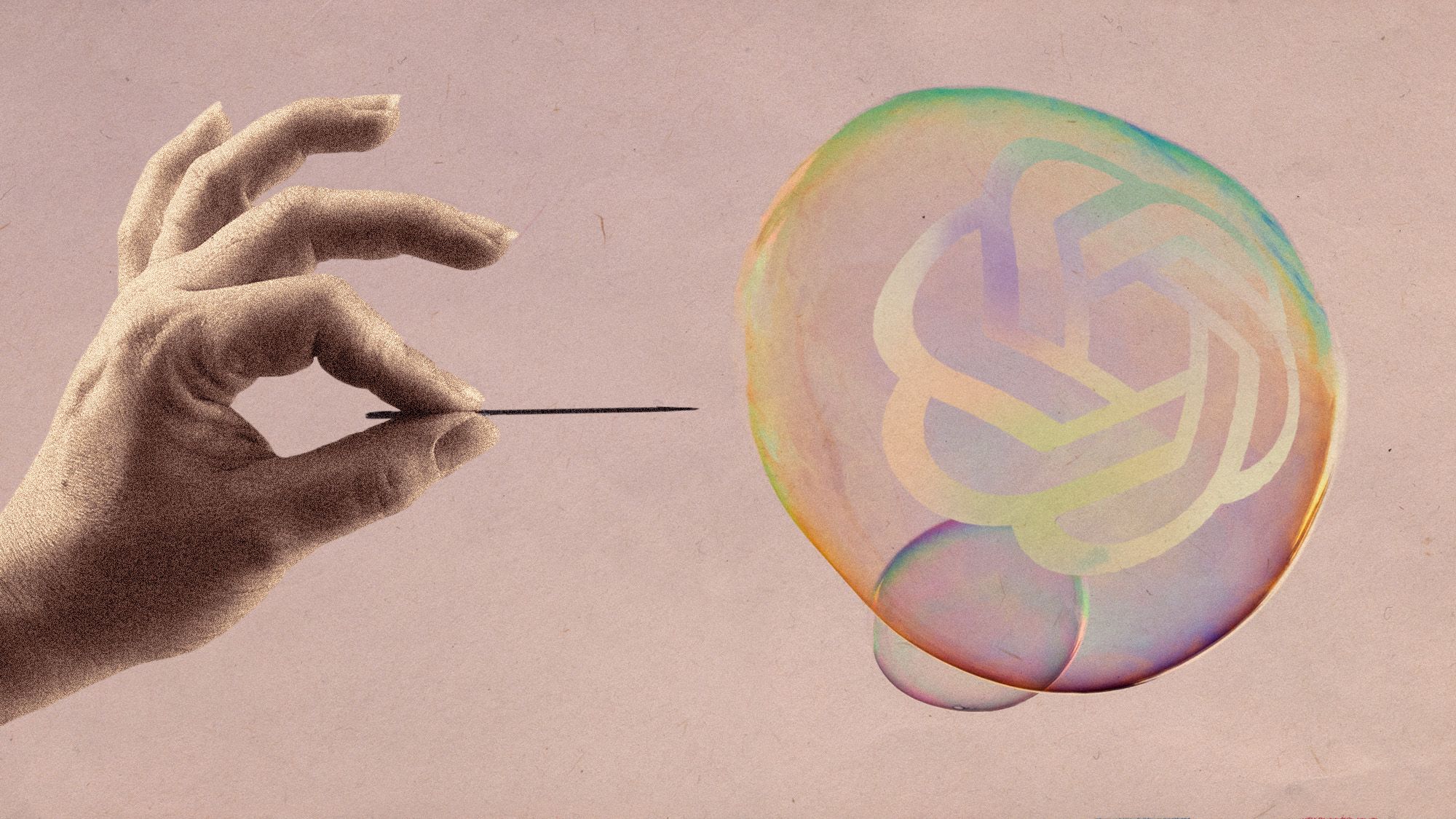

Global financial experts are raising concerns about a potential market correction, drawing parallels to the 1929 crash that preceded the Great Depression. These warnings stem from a confluence of factors, including escalating trade tensions, substantial national debts, and a potential overinvestment in the artificial intelligence (AI) sector.

Prominent voices, including financial journalist Andrew Ross Sorkin, are sounding the alarm. Sorkin, promoting a new book on the 1929 crash, highlights the historical context of market collapses. Other experts, such as G20 risk watchdog Andrew Bailey, point to economic and political uncertainties as catalysts for a potential market adjustment. Bank of England officials have also expressed concerns about the AI bubble, suggesting a possible burst in tech stock valuations. Similarly, JP Morgan CEO Jamie Dimon has voiced worries about a significant market correction. International Monetary Fund chief Kristalina Georgieva has cautioned that uncertainty is the new normal.

The current economic climate shares some similarities with the pre-1929 era. The 1920s were characterized by trade protectionism, social unrest, and the emergence of new technologies. The rapid growth and investment in AI, particularly, is drawing scrutiny. While tech companies are investing heavily in AI, the return on investment remains uncertain. The spending on AI this year exceeds the total cost of the Apollo moon program, yet consumer spending on AI services is significantly lower. This disparity has led some analysts to identify an economic bubble.

However, some analysts caution against overreacting. The boom in tech investment is largely driven by well-established companies with strong financial positions. While bubble bursts are dramatic, they are relatively rare events. Historical data indicates that significant market drops are infrequent.

BNN's Perspective: While the concerns raised by financial experts are valid and warrant attention, it's crucial to maintain a balanced perspective. The current economic landscape is complex, and predicting market crashes with certainty is difficult. Investors should remain vigilant, diversify their portfolios, and make informed decisions based on a thorough understanding of the market dynamics.

Keywords: financial market crash, 1929, AI bubble, economic uncertainty, trade wars, national debt, market correction, Jamie Dimon, Andrew Ross Sorkin, investment, stock market, Great Depression, economic bubble